The Economics of Ideas: Paul Romer, former Berkeley Economics Professor, receives the 2018 Nobel Prize

How the work of Nobel Laureate Paul M. Romer promoted cross-fertilization of ideas to enhance our understanding of the dynamics of long-term prosperity, catch-up growth and international development

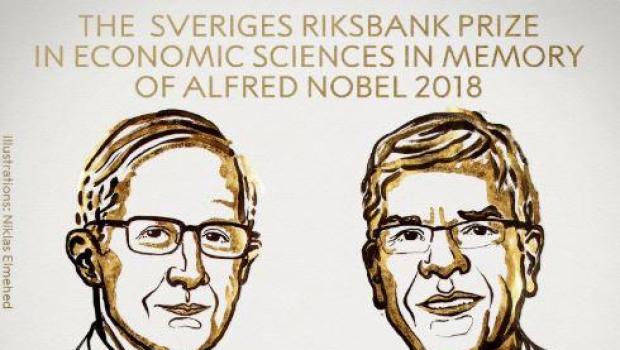

The University of California, Berkeley, has been affiliated with a distinguished list of Nobel Laureates, many of whom produced groundbreaking research during their tenure at Cal. As has been shared widely, The 50th Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel was awarded on October 12th to Professor Paul M. Romer (jointly with William Nordhaus who has contributed to environmental economics and climate change research). Romer, currently Professor of Economics at the NYU Stern School of Business, was at the UC Berkeley Economics Department during 1990-1996. We met in 1991 when I joined the Econ Department as a doctoral student and had the opportunity to be his research assistant, teaching assistant and advisee.

From my personal and professional interaction with Romer, I can attest that he was not only a great contributor to the vibrant macroeconomic scholarly work produced at UC Berkeley, but also a superb teacher for his students. My own doctoral research focused on international technology diffusion, exploring how global integration impinged on the international flow of ideas, including technical knowledge and information through business networks. This work looked at spillovers from foreign direct investment, trade-induced technological transfer and the role of international integration of financial markets in fostering innovation and productivity growth.

This research was inspired by Romer’s generous and insightful intellectual guidance as my Ph.D. advisor. He has been a top-notch mentor to many classmates in my generation who benefitted from his unique and enlightening perspectives. When Romer left to Stanford, I remained his advisee and I was fortunate to have also Pranab K. Bardhan become my main advisor, with J. Bradford DeLong and Pablo T. Spiller also as advisors completing my PhD thesis committee. Bardhan had made early contributions on technological change in 1963 and on external economies of scale in 1964, after Kenneth Arrow formalized in 1962 that notion based on the concept of learning-by-doing.

The impact of Romer's influence to research eliciting the determinants of long-term GDP per capita growth is both profound and lasting, including major implications on the role of public policy to foster international development.

Romer received the Nobel Laureate distinction for his role in incorporating technological change and innovation into economic growth models. In particular, he developed the economics of ideas and characterized the nature of knowledge generation in the marketplace. The breadth and depth of his role in expanding the frontier of knowledge on the determinants of long-run prosperity from a macroeconomic perspective, and of the process of economic development, can hardly be overstated.

Some History: Exogenous Growth Theory

In 1956, Robert Solow and Trevor Swan independently specified growth models in which exogenous technological change was the driver of progress. This was a very powerful technical tool to analyze long-term growth trends and perform accounting of how much each input contributes to output growth. However, the productivity growth that resulted from technical change was ascribed to decisions and activities by scientists operating outside the scope of markets. This meant that there was no role for economic policy to directly impact long-term economic growth. There was a sense that the model did not explain the sources of technological change and therefore left unaccounted for the underlying determinants of growth.

This led some scholars to undertake the endeavor to bring R&D into the growth model so that technological change rather than being exogenous was actually explained within the model. Among these scholars were some of Solow’s own students. For example, in 1967, George Akerlof and Nordhaus, who were both Solow’s doctoral students, published a paper on the razor’s edge nature of balanced growth. Two or three years of research later, Nordhaus, by his own account, stopped not fully satisfied with his progress to work on incorporating innovation and technological change into economic growth models.

Part of the challenge was figuring out how to model, in a dynamic general equilibrium setting, the market power that firms must possess to cover R&D costs and thus be incentivized to invest in innovation.

This task was facilitated through the formalization of monopolistic competition. In 1977, Avinash Dixit and Joseph Stiglitz introduced a model of monopolistic competition amenable to comparative statics through aggregation into a constant elasticity of substitution price index and consumer demand of symmetric brands of goods, where preferences reflect a love for variety.

In 1979, Paul Krugman showed in the Journal of International Economics how the Dixit-Stiglitz framework could be embedded into a general equilibrium model of international trade, and later, in 1991, in the Journal of Political Economy he showed how it could be incorporated in a general equilibrium model of economic geography characterizing core-periphery industrialization patterns. These developments established the possibility to formulate tractable general equilibrium models in which producers have market power. The next step was to bring dynamics into the picture.

More Recent History: Endogenous Growth Theory

In the late 1970’s and early 1980’s, Paul M. Romer was a doctoral student at the University of Chicago. During that time, he figured out how to specify and solve a dynamic general equilibrium model such that there was a balanced growth path, as opposed to a steady state, without diminishing returns to scale. In that model, featured in Romer’s PhD thesis and then published in 1986 in the Journal of Political Economy, there was an externality from knowledge spillovers captured through capital accumulation which yielded an aggregate production function with nondecreasing returns. In fact, this led to dynamics with unbounded economic growth as well as the possibility of temporary shocks having lasting effects – as in the case of rapid catch-up observed both during the East Asian Miracle growth and then in China. This model was generically labeled the AK Model. Another similar specification but with spillovers emanating from human capital accumulation rather than physical capital accumulation was developed and published in the Journal of Monetary Economics in 1988 by Robert Lucas – Romer’s PhD dissertation advisor.

Then Romer followed up with another model that he also published in the Journal of Political Economy, in 1990, which had the same sort of aggregate dynamics as the AK Model but where technological change was the outcome of intentional investments by economic agents rather than being the byproduct of capital investment through a serendipitous externality called knowledge spillovers. This was possible by embedding the Dixit-Stiglitz model in the general equilibrium architecture that Romer designed as a PhD student, which had an equilibrium balanced growth path even with nondecreasing returns to scale and unbounded growth. Monopolistic competition gave firms in the model the market power to generate profits needed to cover R&D investment costs that make technological change happen.

A key insight was to develop the economics of ideas based on their non-rivalrous nature. In particular, an idea (or blueprint) can be utilized by many economic agents at once without impeding the possibility of potentially unbounded additional users. This endows ideas with a natural property to generate aggregate nondecreasing returns to scale (constant rather than increasing to obtain balanced growth).

At the same time, Romer noted that the non-rivalrous character of ideas would render investments for their creation unprofitable unless ideas are partially excludable, so that there is scope to regulate access by potential users.

For example, you could use encrypting technology or limited access platforms to charge user fees. Also, rules introduced by governments could limit imitation that left inventors unrewarded. Indeed, the function of intellectual property right (IPR) protections, such as patents, is to provide inventors with incentives to innovate and propel technological change.

The birth of the new field of Endogenous Growth Theory (EGT) led to efforts by scholars to explore the ramifications of Romer’s seminal contribution. This opened the door to deepen our understanding of long-term growth and economic development based on the notion of creative destruction introduced by Joseph Schumpeter. Other contributors to the field include Phillipe Aghion and Peter Howitt (1992) as well as Gene Grossman and Elhanan Helpman (1991).

Indeed, by exploring the determinants of incentives for economic agents to conduct R&D and generally make productivity-enhancing investments, one could study the role of institutional rules and policies in shaping the trajectory of productivity improvement that ultimately determines long-run prosperity as well as development through catch-up growth. Researchers have relied on the insights from EGT to study the impact of public policy and political economy factors shaping up how societies prosper or stagnate based on the nature of their institutions.

Romer’s work opened up the possibility of more encompassing approaches, including cross-fertilization of ideas between fields, to the study of catch-up growth and international development. This research has included the study of why poverty traps can emerge, how growth take-offs happen, what determines whether a country’s growth trajectory converges or diverges relative to other economies, how are “convergence clubs” shaped, and so on. Not all of these phenomena can be characterized in the context of traditional neoclassical or exogenous growth models relying solely on analysis of markets or economic policies.

With EGT, we can bring to our analysis the deep determinants of long-run prosperity across societies that go beyond markets and economic policies to incorporate both the structural determinants of economic interactions as well as public policy more generally beyond the economic dimension. Aside from science policy, which has been one of Romer’s passions, there are other important factors shaping the pace of scientific discovery and its transformation into technological change. Those factors go further than policies that directly impact the rate of return to R&D investment – such as tax rates, labor regulations, immigration restrictions, corruption, etc. – but also more entrenched structures shaping economic interactions – such as political institutions and rules, preferences, culture, social norms and culture, etc.

From the Ivory Tower to Policy Entrepreneurship

Throughout his career, Romer was a maverick and a pioneer not only in the academic arena, in the world of ideas – that he so lucidly modeled – but also in importing his findings into the public policy sphere. This may be to a large extent explained by the fact that his father, Roy Romer, had an illustrious career as a politician – being Governor of the State of Colorado as well as Chair of the Democratic National Committee.

To this day, Paul M. Romer’s passion for policy is evident. Since 2011, he has been working on urban policy at NYU’s Marron Institute of Urban Management, which he founded, exploring the role of cities to spur catch-up growth, with an emphasis on city planning. The objective is to formulate policies leading to urban expansion conducive to economic growth in developing countries. This policy agenda was an outgrowth of his innovative Charter Cities experimental project.

In 1993, Romer became concerned with the perverse incentives embedded in financial regulation that led to the savings and loans debacle. He worked on this issue with his UC Berkeley colleague, Akerlof. Jointly they wrote an influential piece published in Brookings Papers on Economic Activity. They argued that banking policy as reflected in prudential financial regulation had counterproductive effects that overprotected certain financial institutions, actually making negligent as well as willful bankruptcy profitable. Subsequent financial reforms were informed by the analysis of Akerlof and Romer.

This work was emblematic of a vibrant macroeconomic research scene at UC Berkeley during that time whose influence is still persistent. Aside from Paul Romer and George Akerlof, other notable macroeconomist colleagues at the Econ Department included professors Brad DeLong, Barry Eichengreen, Jeffrey Frankel, Maurice Obstfeld, Christina Romer, David Romer, and Janet Yellen. All of them have made substantive analytical contributions while devoting much energy and time to policy endeavors through high level positions in government or international organizations.

I was fortunate to gain research experience from a perspective that blended abstract analytical frameworks with empirical observations about welfare-relevant economic phenomena to generate public policy insights. In 1994, I started working with Romer both as a research assistant and teaching assistant. The research involved both exploring analytical and numerical solutions to growth models as well as identifying the policies to promote industry-university joint ventures and industry boards (e.g. for standards or marketing). The idea, beyond enriching EGT, was to explore how its insights could be brought into action. Because of the nonrival nature of ideas, a decentralized market equilibrium would have a suboptimal level of knowledge generation.

Beyond the role of intellectual property right policy to boost innovation, Romer was keen to explore how different public policy options could be a catalyst to industry level associations for private sector innovation. These options encompassed industry cooperation schemes, including consortia with universities, to overcome collective action barriers. This work concluded by the time Romer departed to Stanford in 1996.

While at Stanford, he came up with ways to improve students’ learning by increasing their effort and engagement to obtain better outcomes without heavy resource constraints. This enhanced accessibility to high quality education. He created in 2000 an educational technology company, Aplia Inc., which was acquired in 2007. The methods developed by Romer to conduct assignments, assessments and experiments for university coursework have now become standard in the educational industry.

In 2001, Romer turned his attention to science policy, this time focusing on the human capital accumulation aspects – namely the determinants of the supply of scientists and engineers. He pointed out that demand side policies subsidizing employment highly skilled quantitative researchers were insufficient unless the supply was also bolstered through support for universities and labs engaging in basic and applied science. This important line of work to formulate the optimal education subsidies is a policy area where much remains to be done towards implementation but where his insights provide guidance for programs that can be implemented when the political circumstances permit for such policy options to be given full consideration.

Romer has continuously combined his research activities with intense inclusion of policy concerns in his work. In 2016, when he was offered the opportunity to join the World Bank as Senior Vice-President and Chief Economist, he accepted the challenge and held the post for a year and a half.

His tenure there was indicative of his avid desire to contribute to better policies, and specifically to promote widespread catch-up growth that substantially can reduce poverty. He has identified that urban expansion was in many fast development episodes a key factor for economic take-off and subsequent productivity growth acceleration. For example, the scale of poverty reduction observed in China with hundreds of millions lifted out of destitution, in a context of swift and planned city development, is unprecedented in human history.

Romer’s towering intellect and his irrepressible passion to think out of the box have resulted in remarkable ideas and enterprises. The Economist of Ideas, he created innovative projects to bring those insights from the ivory tower into the realm of public policy. This powerful combination makes the Nobel Laureate recognition bestowed upon Professor Paul M. Romer all the more poignant in terms of highlighting the role of economists in fostering policy making that has a scientific basis and resonates with social needs, as well as being evidence-based.

Dr. Kugler is a UC Berkeley Economics Ph.D. graduate and a professor of Public Policy at George Mason University - Schar School of Policy and Government.

Oct. 17, 2018

The Economics of Ideas, by Maurice Kugler: How the work of Nobel Laureate Paul M. Romer helped promote cross-fertilization of ideas between fields and promoted our understanding of the determinants of long-term prosperity, catch-up growth and international development.